#$200 000 MORTGAGE PAYMENT 15 YEARS FULL#

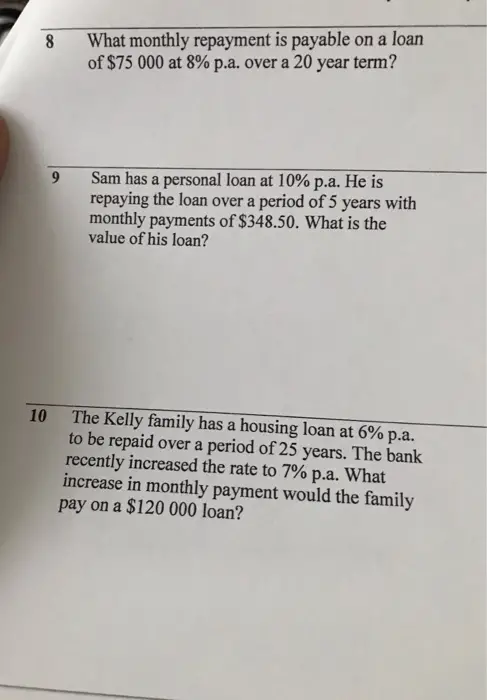

Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Converting years to months: multiply the years in the loan term by 12. Authorised by the Prudential Regulation Authority and with deemed variation of permission. A 20-year loan is 240 monthly payments, A 15-year loan is 180 monthly payments, a 10-year loan is 120-monthly payments and 5 year loan is 60 monthly payments. In the UK, Bank of Ireland is authorised and regulated by the Central Bank of Ireland. Bank of Ireland Group plc, whose shares are listed on the main markets of the Irish Stock Exchange plc and the London Stock Exchange plc, is the holding company of Bank of Ireland.īank of Ireland is regulated by the Central Bank of Ireland. has a lower monthly payment, but adjusting to a 15-year term can save you money. Pay Off Your Boydton Home Faster by Refinancing into a Low-rate 15-year Fixed.

A 1% interest rate rise would increase monthly repayments by €54.02 per month.īank of Ireland Group plc is a public limited company incorporated in Ireland, with its registered office at 40 Mespil Road, Dublin 4 and registered number 593672. Find out what your monthly mortgage payment will be with this mortgage.

#$200 000 MORTGAGE PAYMENT 15 YEARS REGISTRATION#

APRC includes €150 valuation fee and mortgage charge of €175 paid to the Property Registration Authority. A typical mortgage of €100,000 over 20 years with 240 monthly instalments costs €615.79 per month at 4.2% variable (Annual Percentage Rate of Charge (APRC) 4.3%).

Maximum loan is generally 3.5 times gross annual income (4 times gross annual income for first time buyers) and 90% of the property value, (70% of the full property value for Buy to Let) but these limits may vary. You mortgage your property to secure the loan. The more you put down, the lower your mortgage payment will be. Choose a 30-year fixed-rate term for the lowest possible payment, or a 15-year term if you want to save interest and pay off the balance faster with a higher monthly payment. Mortgage approval is subject to assessment of suitability and affordability. You may afford a 200,000 mortgage on a 45,000 income if you have a 3 down payment, a 6 mortgage rate, a good credit score, and no other debts beyond your new housing costs. This is the number of years it’ll take to pay off your loan balance. Monthly payment: Monthly principal and interest payment (PI). Lending criteria and terms and conditions apply. The most common mortgage terms are 15 years and 30 years. Principal Dwelling Homes: The lender is Bank of Ireland Mortgages.

0 kommentar(er)

0 kommentar(er)